A company’s transactions are recorded in a general ledger and later summed to be included in a trial balance. It’s hard to understand exactly what a trial balance is without understanding double-entry accounting jargon like “debits” and “credits,” so let’s go over that next. Inthese columns we record all asset, liability, and equityaccounts. After incorporating the $900 credit adjustment, the balance will now be $600 (debit).

- For example, IFRS-based financial statements are only required to report the current period of information and the information for the prior period.

- Discover the best business bank accounts for sole proprietors in 2025, comparing top banks to help you find the perfect fit for your needs.

- As the name suggests, it includes deductions with respect to the tax liabilities.

- If you’ve ever wondered how accountants turn your raw financial data into readable financial reports, the trial balance is how.

- From this information, the company will begin constructing each of the statements, beginning with the income statement.

Table of Contents

How to Transfer Money from Stripe to Your Bank Account: A Complete Guide

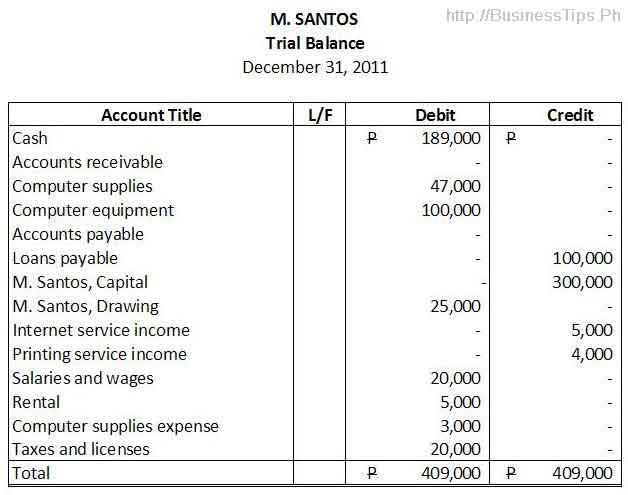

It should look exactly like your unadjusted trial balance, save for any deferrals, accruals, missing transactions or tax adjustments you made. The trial balance is a list of all your business’ ledger accounts, and how much each of those accounts changed over a particular period of time. You may have also heard it referred to as a trial balance sheet as it should be one worksheet summarizing all of your activity for a certain period in time. You will not see a similarity between the 10-column worksheetand the balance sheet, because the 10-column worksheet iscategorizing all accounts by the type of balance they have, debitor credit. If the debit and credit columns equal each other, it means theexpenses equal the revenues. This would happen if a company brokeeven, meaning the company did not make or lose any money.

Trial Balance vs. Balance Sheet

Under US GAAP there is no specific requirement on how accounts should be presented. IFRS requires that accounts be classified into current and noncurrent categories for both assets and liabilities, but no specific presentation format is required. Thus, for US companies, the first category always seen on a Balance Sheet is Current Assets, and the first account balance reported is cash. The accounts of a Balance Sheet using IFRS might appear as shown here.

Cash or Accrual Basis Accounting?

The five column setsare the trial balance, adjustments, adjusted trial balance, incomestatement, and the balance sheet. After a company posts itsday-to-day journal entries, it can begin transferring thatinformation to the trial balance columns of the 10-columnworksheet. Once all ledger accounts and their balances are recorded, the debit and credit columns 16 examples of negotiation strategy on the trial balance are totaled to see if the figures in each column match each other. The final total in the debit column must be the same dollar amount that is determined in the final credit column. For example, if you determine that the final debit balance is $24,000 then the final credit balance in the trial balance must also be $24,000.

Remember, you do not change your journal entries for posting — if you debit in an entry you debit when you post. After we post the adjusting entries, it is necessary to check our work and prepare an adjusted trial balance. For example, Cash has a final balance of $24,800 on the debit side. This balance is transferred to the Cash account in the debit column on the unadjusted trial balance. Accounts Payable ($500), Unearned Revenue ($4,000), Common Stock ($20,000) and Service Revenue ($9,500) all have credit final balances in their T-accounts. These credit balances would transfer to the credit column on the unadjusted trial balance.

Income Statement and Balance Sheet

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. A trial balance is a list of all accounts in the general ledger that have nonzero balances. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. An adjusted trial balance is usually the last step in the accounting cycle because the financial statements are prepared after this. This adjusted trial balance is a report in which all the debit and credit balances are provided.

This balance is transferred to the Interest Receivable account in the debit column on the adjusted trial balance. Accumulated Depreciation–Equipment ($75), Salaries Payable ($1,500), Unearned Revenue ($3,400), Service Revenue ($10,100), and Interest Revenue ($140) all have credit final balances in their T-accounts. These credit balances would transfer to the credit column on the adjusted trial balance.

The unadjusted trial balance is prepared on the fly, before adjusting journal entries are completed. It is a record of day-to-day transactions and can be used to balance a ledger by adjusting entries. Looking at the income statement columns, we see that all revenueand expense accounts are listed in either the debit or creditcolumn.

This trial balance has the final balances in all the accounts, and it is used to prepare the financial statements. The post-closing trial balance shows the balances after the closing entries have been completed. All three of these types have exactly the same format but slightly different uses.

التعليقات مغلقة.